Introduction: FamPay, now rebranded as FamApp is a financial platform designed for the younger generation in India. It focuses on financial inclusion, aiming to provide teenagers and young adults with a seamless and secure way to manage their finances. FamApp offers a unique “Spending Account” that allows users to save, spend, earn, and learn about money.

Overview:

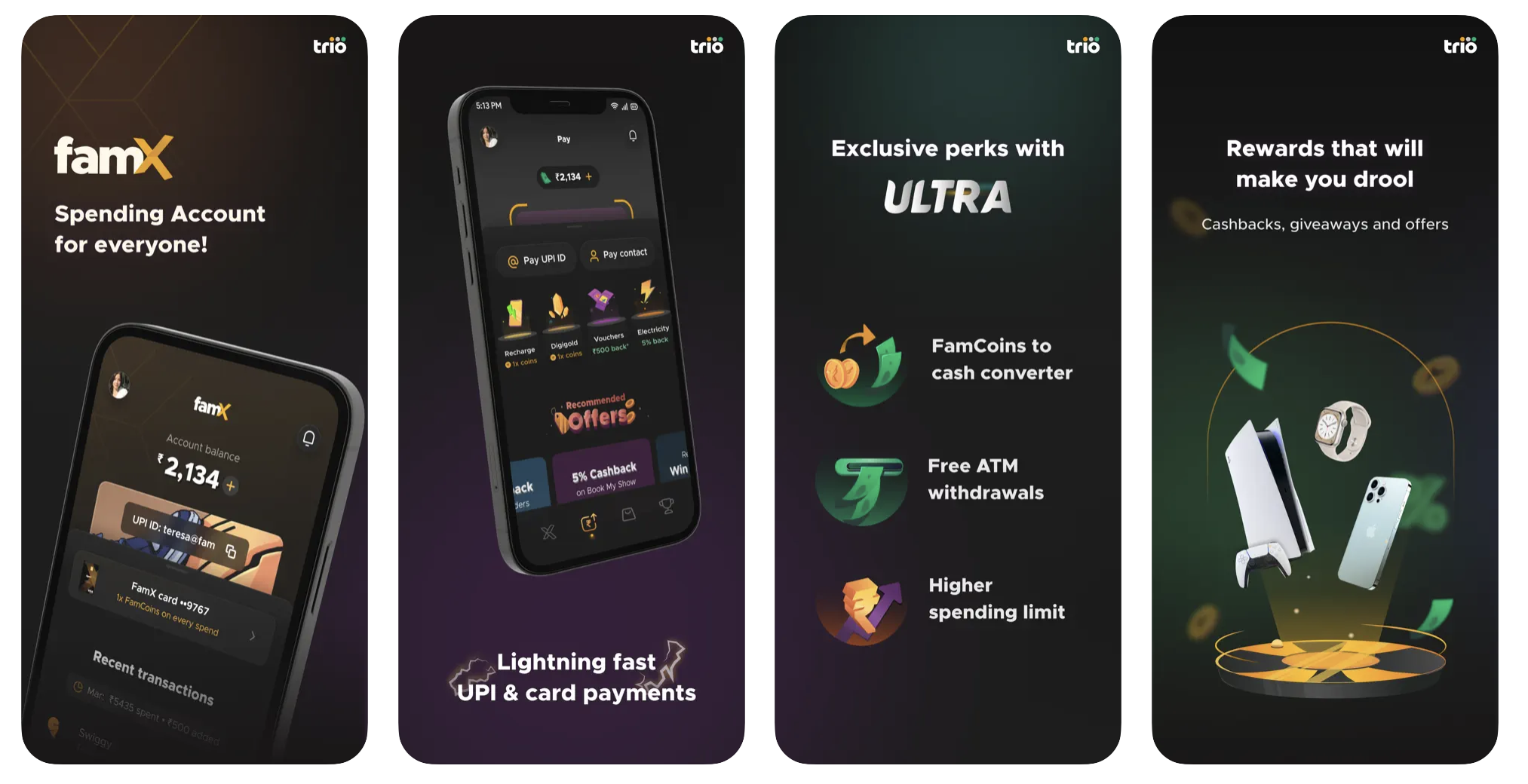

- Serviceable Age Group: Open for everyone ages 11 and above.

- Unique Selling Proposition: India’s first-ever doodle card for teens and a spending account without the need for a traditional bank account.

- Key Offerings: Customized UPI & card, numberless card, and memberships tailored to users’ needs.

Key Features:

- Universal Spending Account:

- Provides users with a card & UPI linked to their FamX account.

- Enables payments that are quick, easy, and accepted universally.

- Helps users easily track expenses and keep their bank statements organized.

- Customized UPI & Card:

- Allows even teenagers to have their own customized UPI and card.

- Offers UPI payments that reportedly take less than 2 seconds.

- Users can choose personalized QR themes to match their style.

- Rewards & Offers:

- Provides cashback, discounts, and offers from popular brands.

- Offers FamCoins on everyday spending and exciting discounts from top brands.

- Users can win prizes from spinners and giveaways.

- Numberless Card:

- Ensures user information safety with a card that doesn’t display numbers.

- Offers quick and secure payments with the Tap & Pay feature.

- Users can design their own cards with doodles and even make ATM withdrawals.

- Support & Community:

- 24x7 active support team available for user queries.

- Over a million satisfied users, with testimonials highlighting the app’s efficiency and unique features.

Market Position & Competitive Advantage: FamApp has positioned itself as a pioneer in financial services for the younger generation in India. Its competitive advantages include:

- Youth-Centric Approach: Designed specifically for teenagers and young adults, addressing their unique financial needs.

- Innovative Features: From numberless cards to doodle designs, FamApp offers features that resonate with its target audience.

- Financial Education: By allowing young users to manage their finances, FamApp provides practical financial education.

Challenges & Opportunities:

- Scaling: As FamApp expands its user base, ensuring consistent service quality and feature availability will be crucial.

- Regulatory Challenges: Catering to a younger audience might bring regulatory challenges, especially in the financial sector.

- Diversification: Exploring additional financial products or services tailored for the youth can provide FamApp with growth opportunities.

Conclusion: FamApp, formerly FamPay, has successfully tapped into a niche yet significant market segment - the young generation. By offering them a platform to manage their finances independently, FamApp not only provides financial services but also imparts essential financial education. As the platform continues to grow and evolve, it will be essential to address challenges proactively and seize new opportunities to remain a market leader in this segment.